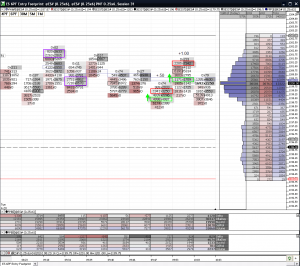

I guess if you hang around the markets long enough you just have a 6th sense about no conviction days. I don’t know if it is fortunate or unfortunate that I was right about today and these levels. I did scalp the first move up to 1.50 and then the first bounce of the VPOC/VWAP at 1200 for a tick each (in purple), but the order flow didn’t warrant anything else. I then got a nice fill at 99 when sellers finally exhausted but it was stalling under 1200 again so I got spooked and bailed at 99.50. Just after my bailout the momentum came back so I bought 1200.25 on a felling and traded into my modified new target of 1201.25 just in the nick of time as it stalled again. We might wait for a fade of 1203 but I doubt it. We will not fade 99/98 again or 1.50 again though. We also might sell 98 or so into 96.50 95.25 if it comes up as well, but again, I doubt it. The market just can’t make up its mind today and volume is too light for our liking. At +1.50 though we are way ahead of our modest goal anyway so we are fine. Remember, we are happy as clams with just 3 points a week. With our risk model that is over 70% in annual returns and enough to keep us in the top 5 on all the lists forever. Be careful today guys…

8 Responses to “4/20/2010 Post Trading Analysis”

Sorry, the comment form is closed at this time.

Hi Guys, Nice comments today. Bought 98.75 today for 8 tics. I liked the well defined balance areas

on the O/N profile, but was cautious around this level. I also liked your comment about buying on “feel”.

I often get an intuitive urge to buy or sell but end up just watching. Jess

Nice trade. I’m sure I don’t have to tell you that when you learn to refine and trust your intuition and urges that is when you have truly found your edge. We are all break even traders at the core. Otherwise there would be no constant tug at every price or any balance areas. Perfectly imperfect. It is just the smallest little things that seperate a break even trader that bleeds off whatever he makes in transaction costs and the rock star that places in the top 5 on the Barclays list (as our group has more than a few times actually). My point is what it takes to be great isn’t much at all really. Just good common sense and a cool head. Most in our group are educated only to the Bachelor level but most of the best traders I know are dumb as fence posts actually. That is why they can’t move upstairs from the floor. They have a hard time figuring out how to “read” the computer like you can read the floor. Those of us that came from that world have figured that out that survive. I can tell you are coming up to a point where you can be as good as anyone.

Thanks RG, for you words of encouragement.

Survey question for you all – do you develop your own levels and/or do you get genuine use of our stuff? If so, what of what we provide is of most interest to you? Levels? Trades? Pre-Market Commentary? Post Trading Analysis? Marked up charts? We officially launch with the first MD webinar and we want to know what appeals to folks the most. There are more signed up than any webinar ever in the history of MD which is good but I have no idea what the typical user is most interested in

I like your whole approach, from pre to post market analysis. It is clear and easy to understand. Where I would like more explanation is where you have marked up the charts for entry and exit, what your thought process is, when looking at the data from MD.I would like to see more written detail on the chart.

You use a 6 or 4 tick reversal chart. Why does this chart help you in particular? When using different periodicities like delta or % delta, which is more accurate. I am thinking it makes more sense to have the delta as a percentage of total volume because I am assuming the same absolute delta is going to have a different impact depending on background volume.

I have been using my own levels for some time and tend to go for larger moves but the real value for me is repeating your trades with market delta on replay. That is invaluable.

My levels today were short 01 to 01.75 and 03 or buy 98.75 and 97. I sold 1.50 down for 3 ticks once it couldnt clear the 1.75 Maybe I let it go a bit early, but I just need to make one good trade a day, get 3 points a week, and let the probabilities play themselves out over time…I will work on carving the extra tick on the front and back side over time.

Good job caljr, you’re approaching trading in a professional manner. Here’s a couple trading cliches for you:

– Plan your trade, trade your plan.

– It’s much better to cut a profit short than to let a loss run.

NJ

Hi NJ It is good to have a plan and much better structure going into the session, plenty of thanks to you guys…