Methodology Framework

Since the vast majority of retail traders we encounter are trading the E-Mini S&P 500 futures (ES), we decided to use what we have discovered (and haven’t) about that market through our experiences in both the discretionary and quantitative arenas as a principal anchor for the community. But it is important to note that all the general model development, processes contained in the various whitepapers, and literally everything we share regarding risk model development and conditional adaptation can be applied to ANY LIQUID MARKET. The community is diverse in this regard and at any given time is populated by members trading many different markets including indexes, rates, energy, ags, softs, and most recently cryptocurrencies. But with regard to ALL markets you should know that in all our years of research and development, we have yet to identify an entirely MECHANICAL single market INTRADAY methodology which is consistently profitable across the wide range of market conditions encountered over a decade or more. Nor have any of our industry peers to our knowledge for that matter. In our experience the most viable paths to consistent performance trading short term single market strategies tend to be volatility adaptive discretionary approaches anchored by repeatable execution criteria, but which gain their primary edge through incorporation of market structure and context along with creative management of risk and bankroll. The key point to take away here being that consistent performance is rarely if ever achieved through any rigid, pattern based mechanical entry criteria and/or fixed tick stop and target schemes. As such, the methodology variants most pursue here are RISK MANAGEMENT focused, highly adaptive, personality trait driven and rooted in simplistic price discovery via the natural auction process common to all liquid markets regardless of strategy or periodicity specifics. And due to the adaptive nature of the approaches advocated, many members over the years have continued to apply variants of the same methodology frameworks to markets other than the ES including other equity indexes, interest rates, currencies and other liquid commodities.

There are several detailed methodology framework whitepapers/videos provided to serve as strategy specific sample references for members to use as guides when developing their OWN models. These range from the original intraday swinging strategy and have been expanded to include multiday swinging & multi-strategy non correlative portfolio architecture, pure orderflow based tick scalping, and coming soon intermarket spread trading.

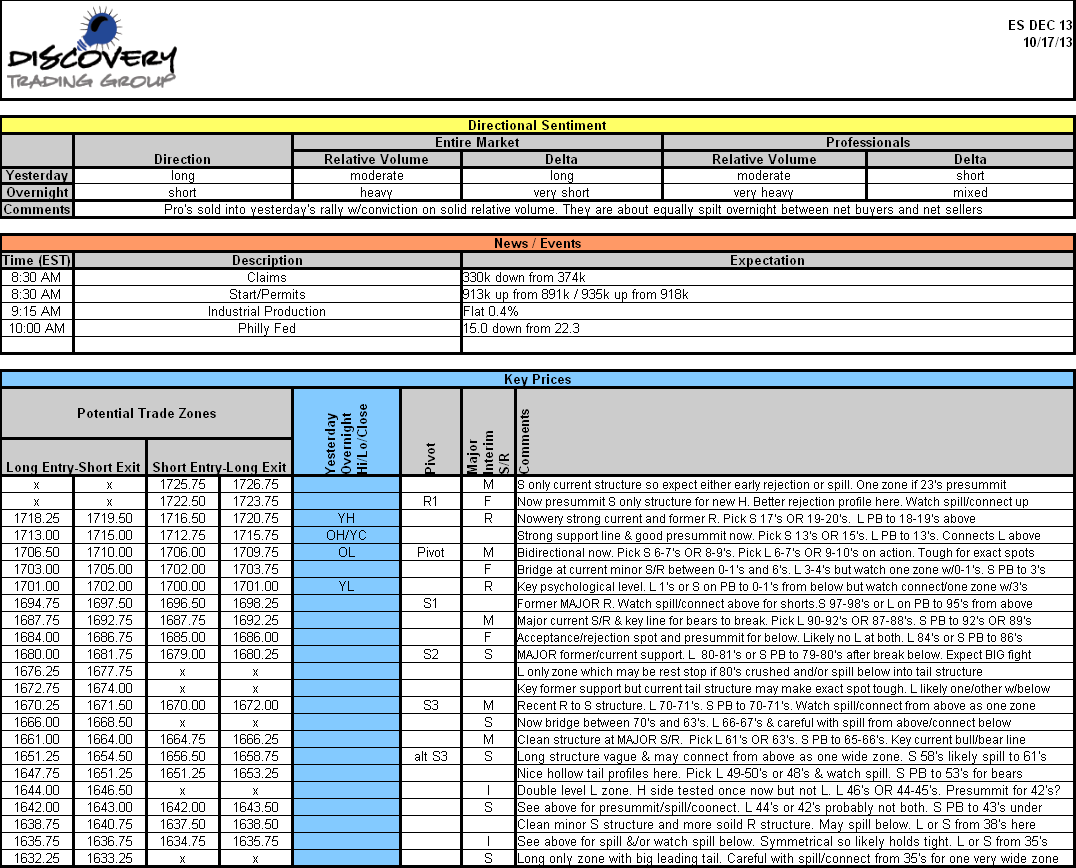

Each day one of the founders posts a relatively detailed document called the ES Trade Plan Worksheet. On the sheets you will find each key market structure possibly relevant to traders across a wide range of periodicities defined by an upper and lower price limit defining a “sweet spot” for potential entry and/or exit, along with comments about it’s significance or expectation of action around these areas. These key structures are separated into often overlapping long and short zones. Long zones are for potential new long entries or exit/scale points for existing short positions. Short zones are for potential new short entries or exit/scale points for existing long positions. In addition, there are sections for any economic releases for the day and a breakdown of both broad market and larger participant volume/directional convictions with comments for both the prior day session and the current overnight session ahead of the cash index market open.

The market structure zones on the daily worksheets are examples of areas where members expect BOTH buyers and sellers across a range of relevant periodicities to frame execution decisions with a high degree of probability. These battles tend to manifest potentially profitable ranging activity around these areas at the very least and in many cases significant market turns or continuations of momentum or trends. Most methodology variants seek to derive edge from a consistently better than even money probability that various price action and orderflow activities around these key structures will often signal directional outright trading opportunities with mathematically advantaged reward to risk characteristics over a reasonable number of occurrences.

In addition to the daily plan sheet we also post a recap of the day’s trading showing how the market respected (or didn’t) the key structures as anticipated along with detailed educational examples for each strategy variant. The idea is for members to see repeatability of their chosen process type and open discussions related to strategy, market context and potential risk management considerations which hopefully everyone can learn something from and apply to their own model development. All are encouraged to make use of the ongoing example content by asking questions and interacting with the founders and the rest of the community. Though the community has just recently been expanded to include educational example streams for additional strategies, there are currently over TEN YEARS of daily detailed, text annotated intraday swinging examples in the members area.

If you are interested in learning more and taking your trading to the next level, inquire about becoming a part of our totally unique community here: