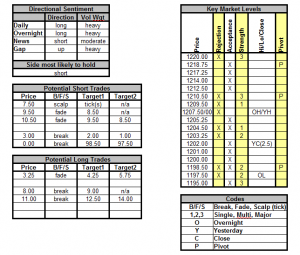

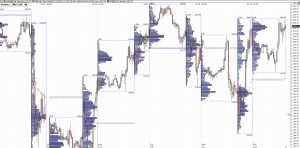

The volume continues to pour into the long side yesterday and overnight into the morning. Durable goods missed a bit but it is a very volatile index which is worthless without looking at rolling smoothed results. That said, we did see an immediate correction down for a potential pre-market gap fill. The 3.25 fade long may actually happen pre-market. Overall volume overnight was also heavy overall which many times negates the gap fill as directional conviction the other way is too strong. Where we go today will probably not be decided right off the open as there are too many mixed messages the market needs to sort out – like Greek debt and it’s fragile yield curve potentially being downgraded to junk and the resulting pressure on the Euro, but a potentially positive home sales number. On the high side all eyes are on 1210.50 and on the low side the line is at the 93 handle. Everything under there is selling and that is our call for interim support today. We will look to 3.25 as the line in the sand for either a fade long back into balance at 4.50-5.75 or breakdown short into 1202-1201. If we really sell off we would sell under 1200 into 98.50-97.50. On the other side WATCH OUT fading 7.50 other than to scalp the volatility. Better to catch a little long from 8 into 9 and then fade 9.50 at least for a scalp. We will be REALLY careful fading the 10.50 level if we get there. It is all about order flow as we may see strong optimism to continue if we manage to get that far. Long from 11 into 12.50 and on to 14 is pretty safe in our view. For those wanting to squeeze every last drop of a move up watch out past 17-18 for a very strong rejection and take profits ahead of those levels. Of course we not visit any of the highs or lows given it is Friday and volume may lighten up if news is uneventful.

Apr 232010

Sorry, the comment form is closed at this time.