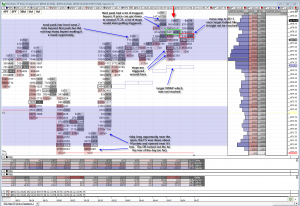

This morning was tough trading. The ES opened in our 71 / 73.5, made a rotation up, and then double bottomed at 70.50. This long opportunity was perplexing because the ES was down around 14 points and opened close to the low. The job claims numbers missed expectations and my assumption is that the ES would want to probe below the bottom again. In this case, I was wrong; the ES turned and went straight up 9 points. I thought the opportunity was too risky and missed it.

The ES next moved up into the 76.50 / 79 level area. The second push moved 2 ticks beyond which created another interesting situation. Here we had the push beyond, yet there were only about 1600 buyers trapped; not really enough to consider trading in the middle of this level range. If the ES was up near the top of the level range, then it would have been a better opportunity but still a little weak. Thus a trade was not taken. The next push up gave us a better shorting opportunity. There were plenty of trapped buyers and price had moved to the back edge of the level range giving us more room for a good target. I had selected the VWAP as the target, but unfortunately it fell two ticks short. Once I thought it possible that the VWAP might not be reached, the stop was moved in to break-even plus one tick where it eventually got hit. It’s a shame to give up 6 ticks of in the money profit; the trade should have probably been exited earlier… Now looking back on the trade, the HVN at 76.50 would have been a better target.

2 Responses to “8/12/2010 Post Trading Analysis”

Sorry, the comment form is closed at this time.

Very interesting. I took the DB trade long right after the open. They were hammering the bid and it was going nowhere, felt like they were trying too hard.

But the interesting part is that after my target was hit, I had a queasy feeling in my stomach as opposed to the usual feeling of relief and satisfaction after a trade well done. I felt like maybe I had been more lucky than good. Your passing on the trade (you have much more experience than I do) confirms that feeling. I think I took a trade with lower probabilities there and got a bit lucky. It’s those types of trades that can do more damage to a traders psyche, in terms of overconfidence, than the losing trades, in my opinion.

So, again, thanks for sharing your read on the markets.

If the ES was down say 6 points instead of 14 points and the Jobs numbers reasonably met expectations, that long opportunity would have been a slam dunk. However, no one can ever know what the market will do next. All we can do is trade our beliefs and manage the trade. That’s all we have in our control. We have no control over what the market does…